Member Funds Vietnam Centralized Equitized Membership Fund (VEFF)

|

Tên tiếng anh: |

Vietnam Equitization Focused Member Fund |

|

Abbreviations |

VEFF |

|

Fund type: |

Member fund |

|

Founding: |

25/10/2011 |

|

Investment objective: |

Rely on the advantages of the equitization process of Vietnamese enterprises in general and in the Oil and Gas Group in particular to build a diversified portfolio with the goal of maximizing profitability while minimizing risks. |

Nemo - PVcom Merit Fund - NPMF

|

English name |

Nemo - PVcom Merit Fund |

|

Abbreviations |

NPMF |

|

Fund type: |

Member fund |

|

Founding: |

21/02/2022 |

|

Investment objective: |

To yield stable earnings through investing in fixed income assets such as Corporate bond, Goverment bond…and increase profit through trading portfolio’s assets aimed at getting good return for the fund. |

Securities investment fund means a fund formed from an investor's capital contribution with the purpose of making a profit from investing in securities or other forms of investment assets, including real estate, in which the investor does not have daily control over the fund's investment decisions.

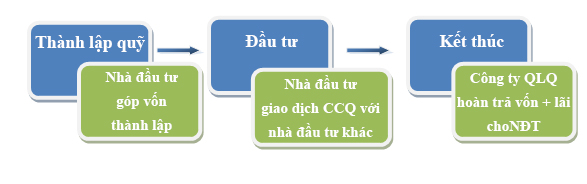

Based on the size, manner and nature of capital contribution: securities investment funds are divided into two types, closed-end fund and open-ended fund.

Based on mobilized capital sources, investment funds are divided into two types: member fund and public investment fund.

Based on the structure and operation of the fund

The Fund closed the fund raising through issuing certificates one by one. Investors who cannot buy Fund certificates at the centralized issuance will only be able to buy back on the secondary stock market from current shareholders like trading stocks. The fund has nothing to do with these transactions. Therefore, closed fund is also called publicly-traded fund. In order to create liquidity for this type of fund, after raising capital (or closing the fund), fund certificates will be listed on the Stock Exchange or only traded on the non-stock market. focus on OTC (Over The Counter) and be traded just like common stock. Investors can buy or sell to recover their investment through the secondary market. Fund certificates may be traded lower or higher than the fund's net asset value (NAV). The closed-end fund has a stable capital structure, so it has the advantage of investing in long-term projects and low-liquidity securities. However, closed-ended VSCF certificates have low liquidity, so market prices are often low and the payback period is long.

|

Characteristics |

Quỹ đóng thành viên |

Quỹ đóng niêm yết |

|

Buy / sell CCQ |

Do not redeem investment certificates directly from investors when they wish to resell |

Do not redeem investment certificates directly from investors when they wish to resell |

|

Capital mobilization |

Released individually |

Widely released to the public. Listed on the Stock Exchange |

|

Investors |

Up to 30 capital contributors, and include only members who are legal entities |

At least one hundred investors, excluding professional stock investors |

|

Risk level |

Member funds carry out relatively risky investment activities, so they can bring about very high potential profits but also contain huge risks, which often the management company will not It is possible to use the Public Fund to invest for capital safety of investors |

Because public funds are mobilized from many investors, their investment activities must comply with many strict restrictions of the law. The fund management company that performs the management work must also comply with a lot of strict conditions in this fund management activity. Therefore, the profit may be lower than the member fund, and the risk is also lower. |

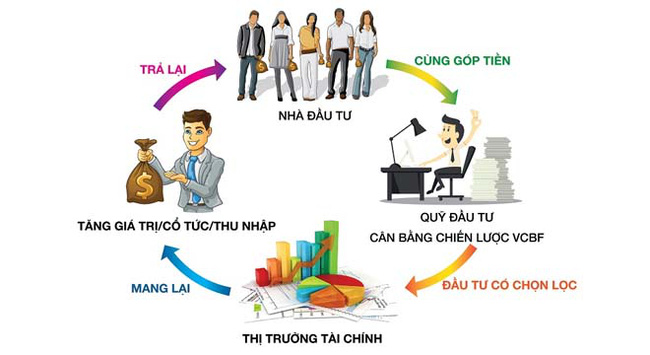

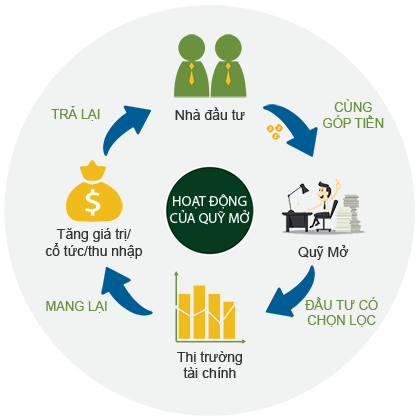

General concept: Open-end funds are public funds that fund certificates offered to the public must be redeemed at the request of investors.

This is a form of mutual fund (Mutual fund) where investors contribute money together to form the Fund to invest in different types of assets such as stocks, bonds, derivatives, etc. The form of open funds is very common in most developed countries and is increasingly spreading to developing countries, especially in Asia. After forming in the US in 1924, open fund formation began to be introduced in Malaysia, Singapore in 1959, South Korea in 1970, Thailand 1977 and China 1991.

Basically, the open-end Fund is not limited in terms of operating time, as well as the number of participating investors and the fund. The Fund is allowed to issue new shares continuously to increase capital, and is also willing to redeem fund certificates (CCQ) issued from investors periodically or at any time (due to the Fund's Charter. regulations). Accordingly, the additional or withdrawn capital amount will be issued or the number of CCQs will be decreased. In this way of operation, there is never an oversupply or demand for open-end fund certificates, and they must always reflect the value of the underlying assets. That is, the opening price of CCQ is equal to the fund's net asset value (NAV), calculated by dividing the fund's total assets after subtracting debts from outstanding shares.

NAV = (Total assets - Total debt) / (number of outstanding shares)

Why invest in open funds?

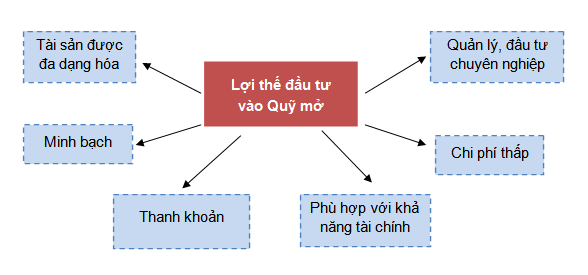

One of the main benefits of investing in open funds is that the investor's funds will be professionally managed by fund management companies. These companies with a deep understanding of the field of investment, working regularly with the market, and extensive relationships and sources of information can make accurate, efficient and economical investment decisions. Costs more than individual investors.

Another important factor in investment is asset allocation. This significantly contributes to the success of the portfolio by minimizing the non-systematic risk of each portfolio asset. While individual investors are limited in financial resources, it is difficult to do this, funds with great financial potential can easily diversify their portfolios with the optimal proportion for each. asset type to minimize investment risk.

Open-end funds are public funds, so the minimum amount of capital required to contribute to the fund is usually reasonable and reasonable so that most small investors wishing to invest in the fund can participate.

In case of necessity, investors may withdraw part or all of the money invested in the open fund, the fund management company is responsible for redeeming the fund certificates with the transaction price equal to the NAV value per fund unit.

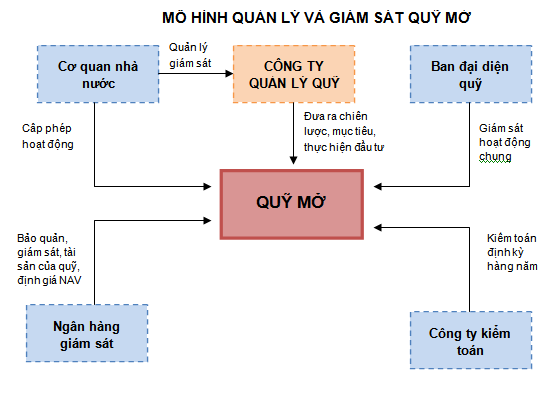

The Fund is strictly supervised by the State Securities Commission, Board of Representatives, supervisory banks and reputable auditing companies.

Open-end investment assets must also be frequently and continuously traded in the market, which will contribute to the transparency and clarity of the value of the Fund Unit.

Information regarding the net assets of open funds is always publicly and regularly disclosed on the fund management company's website, or CCQ distribution agents.

|

Đặc điểm |

Quỹ mở |

Quỹ đóng niêm yết |

|

Thanh khoản của các khoản đầu tư |

Tài sản của quỹ mở thanh khoản cao hơn so với quỹ đóng niêm yết bởi Quỹ chỉ đầu tư vào cổ phiếu, trái phiếu niêm yết hoặc chuẩn bị niêm yết. |

Thanh khoản của tài sản thấp hơn do quỹ bên cạnh đầu tư vào các chứng khoán niêm yết, còn có thể đầu tư vào các chứng khoán chưa niêm yết OTC |

|

Tỷ lệ nắm giữ tiền mặt |

Quỹ luôn để một khoản dự trữ bằng tiền mặt để đáp ứng việc mua lại CCQ |

Tỷ lệ giữ tiền mặt tương đối thấp, tuy nhiên về lý thuyết Quỹ có thể đầu tư toàn bộtiền mặt của quỹ |

|

Giá giao dịch |

Giá CCQ được xác định dựa trên giá trị tài sản ròng NAV/CCQ. |

Giá CCQ được xác định dựa trên nhu cầu mua và bán trên thị trường. Do vậy, giá có thể cao hơn hoặc thấp hơn đáng kể so với giá trị tài sản ròng (NAV). |

|

Thanh khoản CCQ |

CCQ được mua/bán lại trực tiếp với Công ty quản lý quỹ theo định kỳ hoặc tại các thời điểm (được quy định trong Điều lệ của quỹ) |

CCQ được niêm yết và giao dịch trên sàn chứng khoán |

|

Sự thay đổi quy mô quỹ |

Quy mô của Quỹ thay đổi liên tục theo yêu cầu mua vào hoặc bán ra của nhà đầu tư |

Quy mô quỹ vẫn giữ nguyên cho đến ngày đáo hạn (trừ khi tăng vốn) |

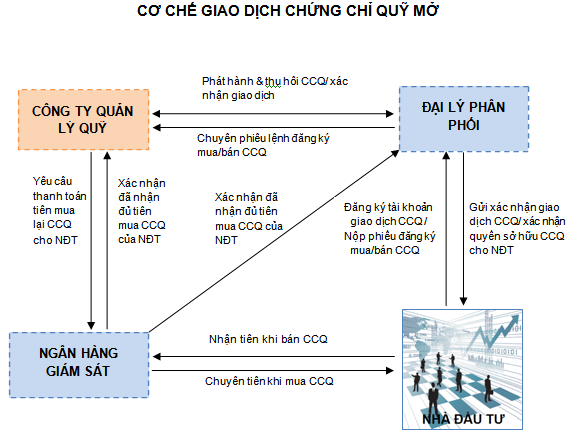

In case of receiving a request to sell the fund certificates of the investor, the Fund Management Company will revoke the respective issued units and send a confirmation to the Distributor, and at the same time send a request to the Supervisory Bank to pay for the money back. into the account of the investor.