1. General concept of ETFS fund

Exchange Traded Fund (ETF): is a form of passive investment fund that emulates a specific index. Accordingly, the fund manager does not need to actively restructure the fund's portfolio but just follow the stock basket of the target index. CCQ ETF is listed and traded on the Stock Exchange.

Types of ETF:

- ETF simulates stock indexes (called ETF Equity, simulating stock index by capitalization, by industry, by geographical area ...).

- ETF simulates debt instruments index (called ETF Fixed Income, simulating government bond index).

- ETF simulates commodity indexes (called ETF Commodity, simulating gold index, agricultural products),

- ETF currency index (called ETF Currency, simulating the currency index of developed countries).

2. Advantages and disadvantages of ETFS fund

2.1. Characteristics and advantages of ETFS

|

Public close fund |

Fund open |

ETF Fund |

|

|---|---|---|---|

|

High liquidity |

CCQ is listed and traded on the Stock Exchange. |

CCQ is not allowed to trade on the Stock Exchange, but investors may ask QLQ to buy back CCQ on a certain number of days (at least twice a month) |

CCQ ETF is listed and traded on the Stock Exchange. The issued CCQ can trade on the primary market (via swaps), or trade directly on the SEs. |

|

Market price CCQ protects investors |

Market price of CCQ depends on supply and demand in the market, may be discounted against NAV / CCQ |

Redemption price according to NAV / CCQ value at the time of acquisition |

CQ price is traded around NAV / CCQ value. Any price difference will be balanced by Arbitrage investors |

|

Low management costs |

Active investment management and high management and research costs. |

Active investment management and high management and research costs | Investing in high liquidity assets Passive investment management, investment simulated by a certain set of indicators, low management costs Risks and profits are equivalent to the risk and profitability of the simulated index |

|

Capital is fully utilized |

It is possible to use the entire capital of the fund to invest. |

Always keep a cash, or high liquidity assets to buy back CCQ of investors when required to invest in the entire |

ETF is real estate fund. |

|

Flexible mobilization and withdrawal |

The additional issuance of fund certificates must have a plan for issuance and use of capital, etc., which is complicated by the General Meeting of Investors and may miss out on investment opportunities when the market recovers. Recovery and withdrawal procedures are fast and flexible. It is not necessary to seek opinions of the General Meeting of Investors but only through the approval of the Board of Representatives |

Mobilization and withdrawal of capital are quite flexible. Authorized participants and investors only need to send a request to the QLQ Company to exchange DM securities structure for CCQ ETFs and vice versa. |

Authorized participants and investors only need to send a request to the QLQ Company to exchange DM securities structure for CCQ ETFs and vice versa. |

|

More transparent information |

- Monthly, quarterly and annual reports on investment activities of the fund; quarterly, semi-annual and annual audited financial statements. - Announcing on the company website weekly about changing NAV / CCQ of closed fund; |

- Periodic reports to investors monthly, quarterly and annually - Announcing on the company website the summary reports, financial reports, statistical reports on transaction fees, semi-annual and annual fund operation reports. - Reports sent to investors and published on websites such as closed-end funds and open funds. |

- Announcing daily NAV and NAV / fund value of the fund - publish information of continuous reference index during the session on SGDKC website and weekly error tracking error on the fund management company's website |

2.2. Disadvantages of ETFS fund

|

Passive investment strategy |

Only suitable for investors who love passive investment strategy, accept system risks. Not suitable for investors who like to research, choose stocks, decide when to enter and exit the market.. |

|---|---|

|

Difficult to achieve outstanding profits |

Even if the market in the period of strong growth, the Fund will hardly gain higher profits than the market |

|

Difficult to manage errors in simulations |

Because the activities of splitting, merging, issuing bonus shares ... of enterprises often take place, plus the costs incurred when operating ETFS, the reduction of tissue errors Fund management companies' simulations become more difficult, especially in cases where the market lacks liquidity |

3. Regulations on establishment and management of ETFS

3.1. Conditions for establishment and management:

|

Participants |

- QLQ Company - Supervisory and custodian bank - Company stock - Vietnam Securities Depository - Stock Exchange - Other securities business organizations, ... |

|---|---|

|

Conditions for fund establishment |

- At least 2 fund founders + Minimum charter capital: VND 50 billion. Each investor, fund founder must buy a minimum of 1 lot of CCQ (> 100,000 CCQ). + Foreign investors are not restricted in the ownership rate in ETF |

|

Requesting fund founders |

- As an QLQ Company, a securities company and a depository bank - Maintain minimum available capital of 220% within the last 12 months |

|

Reference index |

- Developed and managed by Vietnam Stock Exchange - Built on the basis of underlying securities listed on the Stock Exchange in Vietnam - There are specific, clear, highly representative representations, reflecting the characteristics of the market or industry groups and fields |

|

List of index of reference index |

- Case of stock: minimum 10 shares, proportion of each share does not exceed 20% of index value - In case of bonds: at least 5 bonds, the weight of each bond shall not exceed 20% of the value of the index, except for the index of CP bonds, bills and bonds guaranteed by bonds |

|

Structure of securities list |

- Must have at least 50% of underlying securities to form reference index - The value of structural DM is not lower than 95% of the portfolio value of the reference index (not including the securities that the fund establishes fund, investors are restricted from transfer according to the Law of the law) |

|

Delisting |

- The deviation from the reference index in the latest 3 months exceeds the maximum deviation according to the regulations of the Stock Exchange. The error tracking error is calculated according to the formula:

|

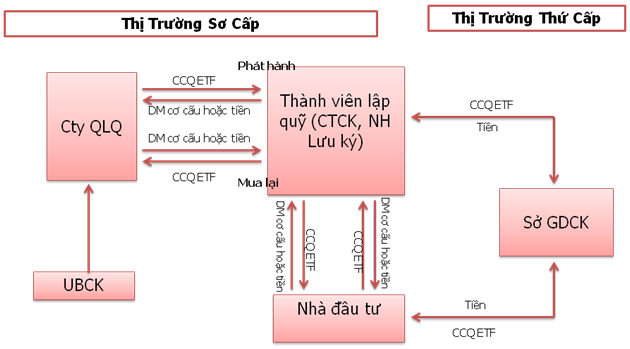

3.2. Operation process of ETFS fund

Primary transactions (Swaps):

- Swap frequency: not less than 2 times / month.

- The trading unit is a CCQ ETF lot of not less than 100,000 CCQ.

- Payment facilities: List of component securities is the main payment instrument. In addition, payment can be made in cash.

Secondary transaction (Transfer transaction):

- Transaction frequency: Every day, the minimum trading volume depends on the regulations of the Stock Exchange to which the fund is listed.

- Payment facilities: Certificate of ETF and money.