1. General concept of REITS fund

1.1. Concept:

A real estate investment trust is also called a real estate investment trust, which is a form of capital contribution to one or more real estate projects from other individuals and organizations, through the issuance of valuable documents. like stocks, fund certificates.

1.2. Characteristics of REITS fund

- Shares of REIT always have high liquidity and the average annual income of the fund is quite stable.

- In essence, REIT is an enterprise set up to specialize in investment (owning) one or several properties.

- Real estate includes apartments, commercial centers, hotels, resorts, offices for rent, warehouses, industrial parks ...

- REIT's income is mostly from the income of its real estate portfolio.

- REIT distributes most of its income to shareholders in the form of dividends.

- REIT can be listed, OTC traded or just a private REIT.

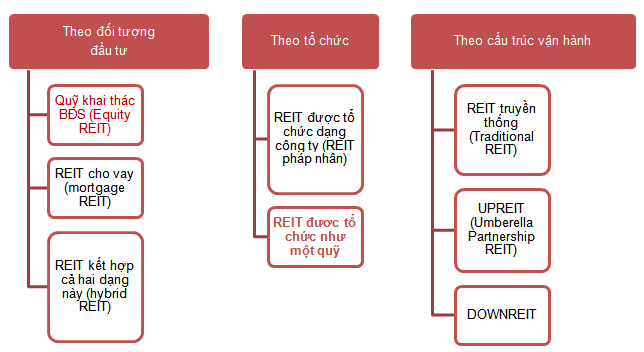

1.3. Classify REITS

2. Regulations on establishment and management of real estate investment funds

|

Details |

Chi tiết |

|---|---|

| Type of fund | - Real estate investment fund is a public close (listed) fund; - Public securities investment company investing in real estate. (must have at least 100 investors). |

| Investment assets | - At least 65% NAV of funds in real estate: + Real estate is allowed to put into business according to the law on real estate business; + Being a completed house or building according to the construction law. - Up to 35% NAV of funds in monetary, bond, listed or unlisted instruments, securities and other assets, ensuring: + Not exceeding 5% of the total asset value of the fund in the securities of an issuer (except for Government bonds) + Do not invest more than 10% of the total circulating securities of an issuer (except for Government bonds) + Do not invest more than 10% of the total asset value of the fund in securities issued by a group of companies with ownership relations. |

| Profit of the fund | - Spend at least 90% of profits made in the year to pay dividends to investors. - Currently the regulation does not mention income tax obligations at the fund level. |

| Quy định về cho vay | - REITS must not borrow more than 5% of net asset value at any time. - The authorized loan must be a short-term loan (up to 30 days) with the aim of covering the necessary operating costs of the fund (avoiding increasing real estate-related loans, but according to the SBV's report). , can be up to 46% of the total credit balance of the system). - Do not use the fund's capital and assets to lend, guarantee loans, deposit or short-sell |

| Fund certificates | - Real estate investment fund is a closed-end fund, not allowed to redeem fund certificates at the request of investors; - Real estate securities investment company has no obligation to buy back issued shares. |

|

Real estate trading activities of the fund |

- Purchase price <= 110% of reference price. - Selling price> = 90% of reference price. - Reference price = price determined by the valuation organization within 6 months up to the time of transaction execution. |

|

Valuation organization |

- Has pricing function. - Not a related person of QLQ, NHGS, a large investor of the fund, not a partner in asset trading with the fund. - There are at least 3 employees with price appraisal card + at least 5 years of valuation experience. - Prestige, experience, professional ethics. |

|

NAV of fund |

NAV = Total asset value - Total liabilities. - QLQ Company must develop a handbook of valuation with the principle of detailed pricing, in accordance with the provisions of law. |

|

Conditions for QLQ Company to manage real estate portfolio |

- Before investing in a real estate category, it is necessary to develop a plan to exploit and use real estate for 5 years; - Must have a real estate fund management department including employees who meet the conditions: + Full civil and legal capacity. + No violations in the field of securities, banking, insurance in the last 2 years. + At least 2 people with certificate of QLQ practice. + At least 2 professional staff with price appraiser card & at least 2 years of valuation experience at real estate trading shareholders. |

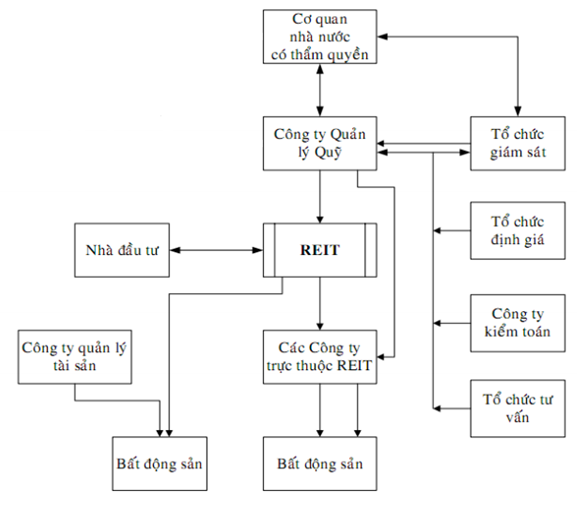

3. Operation model of REITS

4. Advantages of REITS fund

- Low investment scale, high liquidity: Real estate investment opportunities with low capital, liquidity will be much higher than investments in the project.

Market stabilization: On the other hand, the establishment of REIT will help reduce the dependence of business capital, build real estate into credit channel, thereby helping to stabilize the real estate market.

Professional management team: REIT has a strict legal framework and professional management team.

Tax incentives: Diversify investment. Worldwide, income taxes are almost completely exempt from these funds.

High profit for investors: REIT can divide up to 90% profit for investors and only keep 10% to maintain the fund.

Transparency: The transparency of real estate funds is also much higher due to the compact and supervised apparatus.

5. 5. Some legal documents adjusted

- Securities Law No. 70/2006 / QH11 issued by the National Assembly dated June 29, 2006, takes effect from January 1, 2007; and Law No. 62/2010 / QH12 dated November 24, 2010 amending and supplementing a number of articles of the securities law effective from July 1, 2011

- Circular 212/2012 / TT-BTC dated December 5, 2012 guiding the establishment, organization and operation of Fund Management Company;

- Circular Circular 228/2012 / TT-BTC guiding the establishment and management of real estate fund issued by the Ministry of Finance on December 27, 2012, effective from July 1, 2013