1. General concept of investment fund

Securities investment fund is a fund formed from the capital contributed by investors for the purpose of making profits from investing in securities or other types of investment assets, including real estate, in which investors has daily control over the fund's investment decision making.

Based on the scale, method and nature of capital contribution: securities investment fund is divided into 2 types: closed-end investment fund and open-ended investment fund

- Closed- end fund is a public fund whose fund certificates have been offered to the public and cannot be redeemed at the request of investors.

- Open -end fund is a public fund whose fund certificates offered to the public must be redeemed at the request of investors.

Based on mobilized capital: investment fund is divided into 2 types: member investment fund and public investment fund

- A member fund is a fund that mobilizes capital by making a private placement for a small group of investors, the number of capital contributing members does not exceed thirty members and only includes members who are legal entities.

- Public funds are securities investment funds that offer fund certificates to the public.

Based on the structure and operation of the fund

- Investment fund in the form of a company: according to this model, the investment fund is a legal entity, ie a company formed under the law of each country.

- Fund invests in the form of contract: all business transactions of the fund are conducted by QLQ on behalf of the fund. The relationship between investors and management companies is based on the control of the Trust Fund Management Council.

2. Closed-end investment fund:

2.1. General concept:

The closed-end fund mobilizes capital through issuing one-time certificates. Investors who cannot buy fund certificates at centralized issuances can only buy back in the secondary stock market from existing shareholders like trading stocks. The Fund has nothing to do with these transactions. Therefore, the closed fund is also known as a publicly-traded fund. In order to create liquidity for this type of fund, after the end of raising capital (or closing funds), the fund certificates will be listed on the Stock Exchange or only traded on the stock market. OTC (Over The Counter) concentration and trading like common stock. Investors can buy or sell to recover their investment through the secondary market. Fund certificates can be traded lower or higher than the net asset value of the fund (NAV). Closed funds have a stable capital structure, so they have advantages in investing in long-term projects and low liquidity securities. However, the certificate of closed-end fund is not highly liquid, so the market price is often low and the capital recovery time is long.

2.2. Advantages of closed-end fund?

- Increasing profits for investors

- Closed-end investment funds can give investors an optimal level of return compared to open-ended funds

- Investors can buy or sell closed-end investment funds during the trading day

- Reduce investment costs due to the large scale of investment funds.

- Investors' capital is managed by professional and experienced investment experts of a fund management company.

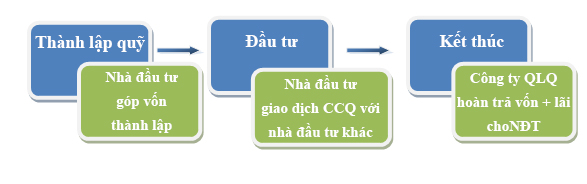

2.3. Operation of closed-end fund

3. Member fund and listed fund

|

Characteristics |

Funds close members |

Listed fund |

|---|---|---|

|

Buy / sell CCQ |

Do not buy back direct investment certificates from investors when they need to resell |

Do not buy back direct investment certificates from investors when they need to resell |

|

Mobilize capital |

Release separately |

Widely released to the public. Listed on the Stock Exchange |

|

Investors |

Up to 30 capital contributing members, and only members who are legal entities |

At least one hundred investors, excluding professional securities investors |

|

Risk level |

The member fund carries out relatively risky investment activities, thus can bring a very high potential profit but also contains huge risks, which often management companies will not You can use the Public Fund to invest for the safety of investors' capital |

Since the capital of public funds is mobilized from many investors, the investment activities of this fund must comply with a lot of strict legal restrictions. The fund management company that performs the management must also abide by many strict conditions in managing this fund. Therefore, the profit may be lower than the member fund, and the risk is also lower. |

4. Some legal documents adjusted

- The Law on Securities No. 70/2006 / QH11 issued on June 29, 2006, takes effect from January 1, 2007;

- Circular 212/2012 / TT-BTC dated December 5, 2012 guiding the establishment, organization and operation of Fund Management Company;

- Circular 224/2012 / TT-BTC dated December 26, 2012 guiding the establishment and management of closed-end fund and member fund, effective from March 15, 2013, and replacing Decision No. 45/2007 / QD-BTC dated 5 June 2007 of the Ministry of Finance promulgating the Regulation on establishment and management of securities investment funds.