1. The general concept of open funds

General concept:

Open fund is a public fund whose fund certificates offered to the public must be redeemed at the request of investors.

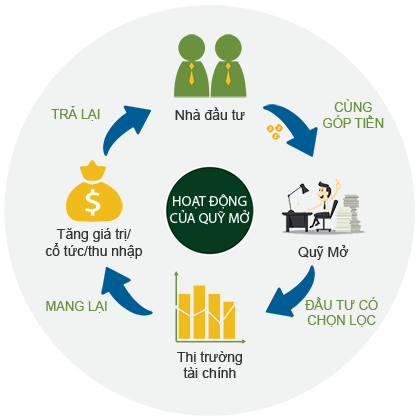

This is a form of Mutual fund where investors contribute money together to form a Fund that invests in different types of assets such as stocks, bonds, derivatives ... Open-ended funds are popular in most developed countries and increasingly spread to developing countries, especially in Asia. After forming in the US in 1924, the formation of open funds began to be introduced in Malaysia, Singapore in 1959, South Korea in 1970, Thailand 1977 and China 1991.

Basically, the Open Fund is not limited in terms of operating time, as well as the number of participating investors and funds. The Fund is allowed to issue new shares continuously to increase capital, and at the same time is willing to buy back fund certificates (issued by investors) periodically or at any time (due to the Charter of the Fund). regulations). Accordingly, the additional or withdrawn capital will be issued or reduced in the number of corresponding CCQs. With this mode of operation, there is never a surplus or demand for open-ended fund certificates, and they must always correct the value of the original assets. That is, the CCQ price is equal to the net asset value (NAV) of the fund, calculated by dividing the fund's total assets after subtracting debts for the outstanding shares.

NAV = (Total assets - Total debt) / (outstanding shares)

Why should invest in open funds ?

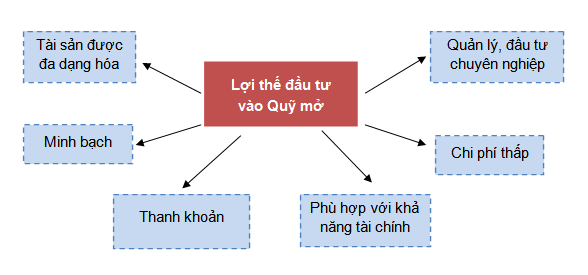

- Professional investment management

One of the main benefits of investing in open funds is that investors' money will be managed professionally by fund management companies. These companies with in-depth knowledge of investment, regular work with the market, and extensive relationships and sources of information can make investment decisions accurate, efficient and economical. Cost more than individual investors.

- Diversification

Another important factor in investment is asset allocation. This contributes significantly to the success of the portfolio through minimizing the non-systematic risk of each asset in the portfolio. While individual investors are limited in financial resources, it is difficult to achieve this, funds with great financial potential easily diversify categories with optimal proportion for each. Asset type to minimize investment risks.

- Consistent with the financial ability of investors

Open fund is a public fund so it often requires a small amount of capital to be contributed to the fund is quite low and reasonable so that most small investors who wish to invest in the fund can participate.

- Liquidity

In case it is necessary for an investor to withdraw part or all of the money invested in an open fund, the Fund Management Company shall buy back the fund with the transaction price equal to the NAV value on a fund certificate.

- Transparent

The Fund is closely monitored by the State Securities Commission, the trustee board, the supervising bank and a reputable auditing company.

Investment assets of open funds must also be assets that are traded regularly and continuously in the market, which will contribute to the transparency and clarity of the value of the fund.

Information regarding net assets of open-ended funds is always published transparently and regularly on the website of the fund management company, or the distribution agents.

2. Some characteristics of the Open Fund

|

Characteristics |

Open fund |

Listed fund |

|---|---|---|

|

Liquidity of investments |

Assets of open-ended funds are higher than those of listed funds because the Fund only invests in listed stocks or bonds. |

Liquidity of assets is lower due to the fund besides investing in listed securities, it is possible to invest in unlisted securities OTC |

|

Cash holding rate |

The fund always leaves a cash reserve to meet the CCQ acquisition |

The cash holding ratio is relatively low, but in theory the Fund can invest in the whole face of the fund |

|

Transaction prices |

CCQ price is determined based on NAV / CCQ net asset value. |

CCQ price is determined based on the demand for buying and selling in the market. Therefore, the price may be significantly higher or lower than the net asset value (NAV). |

|

Liquidity of CCQ |

CCQ is allowed to buy / sell directly with the Fund Management Company periodically or at times (stipulated in the Fund's Charter) |

CCQ is listed and traded on the stock exchange |

|

The scale of the fund |

The size of the Fund changes constantly according to investors' buying or selling requirements |

Fund size remains the same until maturity (except when raising capital) |

3. Operation mechanism of the Open Fund

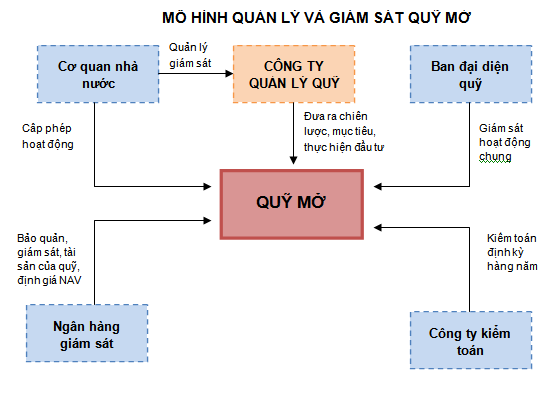

- Fund Management Company: directly implement open fund management, set out investment objectives, strategies and policies and implement investment according to the objectives approved by the General Meeting of Investors.

- SSC: is the direct management agency of the Fund Management Company, is responsible for overseeing all activities of the QLQ Company, together with the investment funds of the company

- Board of Representatives: elected by the General Meeting of Investors, conducting regular monitoring of the fund's activities..

- Supervising bank: supervising, depositing and preserving assets of the fund and fund management companies to protect the legitimate rights and interests of investors

- Auditing company: check and evaluate the fund's activities annually

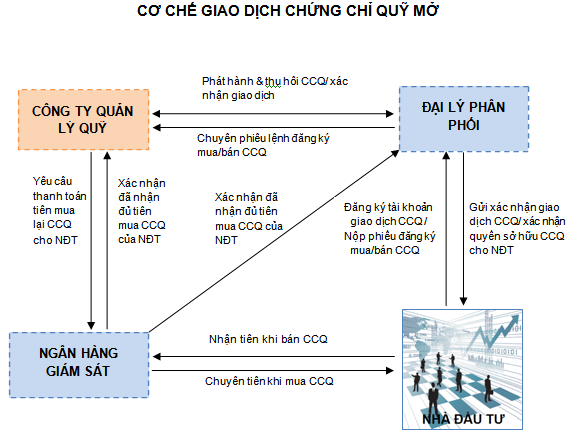

- Step 1: Investor (Investor) after studying documents about the Open Fund, if deciding to join the Fund, open a CCQ trading account at the Distribution Agents designated by the Fund Management Company ( is the direct management unit of the Open Fund).

- Step 2: After having an account, investors may submit a registration form to buy CCQ (or sell the holding CCQ) at a distribution agent on the day of fund certificate trading (specified in the fund's charter). The purchase amount of the fund will transfer directly from the account of the investor to the account of the Fund at the Supervisory Bank.

- Step 3: Distributors after opening a bank account for investors, can receive registration forms to buy or sell investors' CCQ and transfer valid coupons to QLQ Company.

- Step 4: QLQ company after receiving the CCQ coupon of investors, and confirm that they have received enough money to buy CCQ of investors from the Supervisory Bank will issue a number of certificates corresponding to the received amount and send confirmation Transactions to Distributors.

In case of receiving a request to sell CCQ of investors, the QLQ Company will withdraw the issued certificates and send a confirmation to the Distribution Agent, and at the same time send a request to the Supervisory Bank to pay for the redemption. into the investor's account.

- Step 5: Distribution agents send confirmation of trading results and CCQ ownership certification to investors.

4. Some legal documents adjusted

- Circular 183/2011 / TT-BTC dated December 16, 2011 of the Ministry of Finance, guiding the establishment and management of open-ended funds in Vietnam (attached file)

- Circular 212/2012 / TT-BTC dated December 5, 2012 guiding the establishment, organization and operation of Fund Management Company